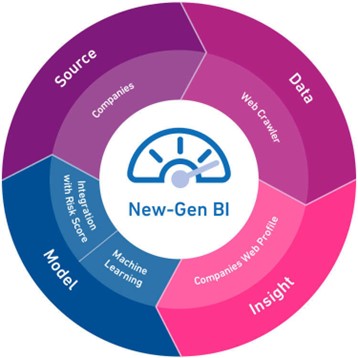

Our innovative WDI score combines alternate and conventional financial data to create a new predictive dimension for SMEs. WDI is developed using Experian Proprietary Machine Learning algorithm to ensure accurate prediction & stability.

How does WDI work?

Experian’s innovative WDI solution helps you assess new risks in your SME portfolio by analysing data from the web, summarizing this into a score. This alternate data score is used for targeting, origination decision making, and early warning collections use cases, enabling you to make smarter decisions for your SME portfolio.

Our comprehensive end-to-end WDI solution adds value to your existing portfolio evaluation matrix, helping you achieve significant reductions in rejections or defaults – and championing your organisation’s overall financial inclusion goals.

Use cases:

- Prospects and monitoring – Develop new segmentation models

- Originations – Automate processes and reduce costs

- Collections – Accurate early warning systems (EWS)

- Potential for high lifetime customer value for evolving SME customer needs

- Fully compliant

How do you use WDI?

One score can add value at multiple decisioning points. Reveal business intelligence (BI) insights to enhance SME targeting, acquisition and portfolio management strategies.

Learn how you can achieve up to 7X uplift in lead generation & profit today!

Contact usCase Studies

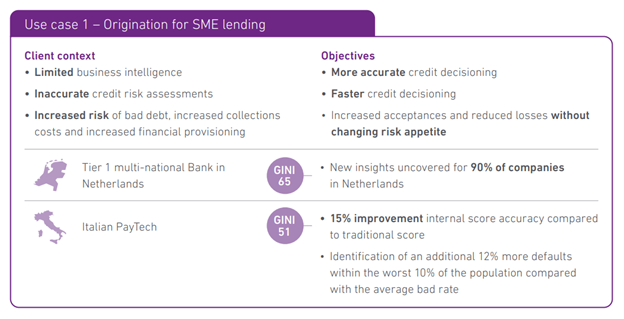

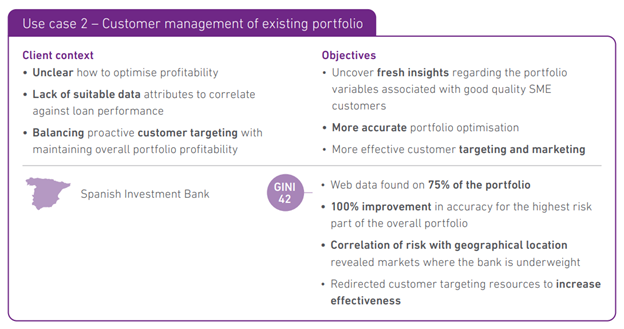

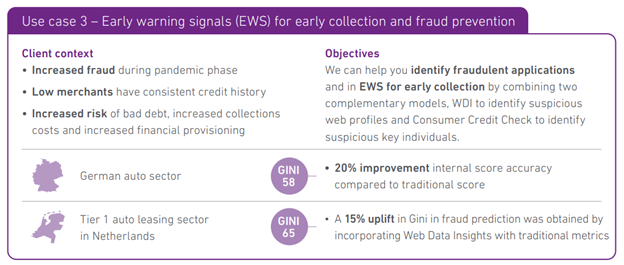

See how Experian WDI has helped SMEs through machine learning model development. The following use cases illustrate how web data scores can be applied across the credit lifecycle.

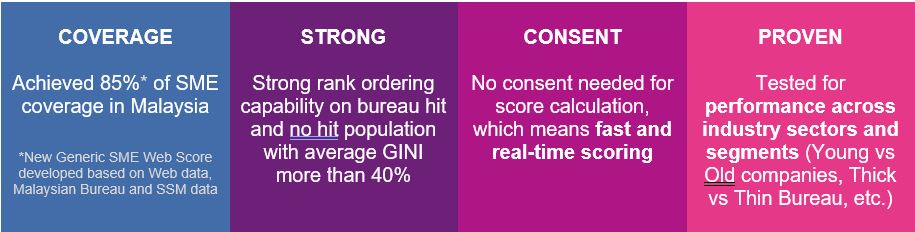

How is WDI different from other scores?

Watch this short video (2.45 Minutes) for more information:

Ready to take advantage of Advanced Analytics?

Gain a competitive edge when you harness the power of alternate data elements in your SME scoring – and add value across prospecting, acquisition and portfolio review.

Find out more about Experian Web Data Insights here